Key considerations for licensing Qi SEPs as wireless-charging space escalates

The Qi standard, established by the Wireless Power Consortium (WPC), has become a crucial technology in wireless charging. It is a universally recognised standard that enables power transfer between devices without the need for physical connectors or cables. It simplifies and improves the charging experience by eliminating the possibility of tangled cables and provides a seamless and efficient way to power electronic devices. This not only enhances user convenience but also contributes to a clutter-free environment. The Qi standard has been widely adopted in various electronic devices, from smartphones and smartwatches to furniture and vehicles that have built-in charging capabilities.

In 2022, the global wireless charging market was valued at US$22.17 billion, with an anticipated compound annual growth rate of 25.8% between 2023 and 2030. As of the end of 2023, the WPC certified over 9,000 Qi products, including smartphones, car chargers, wireless charging pads and LED devices, and was expected to report 1 billion Qi-compliant products sold.

Licensing Qi SEPs

The widespread adoption of Qi makes it a lucrative market for SEP owners, as these SEPs must be licensed by any implementer of the standard. In January 2020, the Via LA patent pool administrator announced a licence for patents essential to the Qi standard, providing a one-stop access point for wireless charging and power transfer. The pool has attracted many of the largest Qi SEP owners, including:

- Canon;

- ConvenientPower;

- GE;

- Hyundai Mobis;

- Intel;

- Philips;

- LG Innotek;

- Panasonic;

- Robert Bosch;

- Siemens; and

- WiTricity.

All Via LA pool members have published lists of Qi-standard SEPs, and these SEP owners commit – under the patent pool licence contract – to license all SEPs for an aggregated pool rate of between US$0.20 and US$0.85 per Qi standard-compliant product (ie, receivers and transmitters). With the expected one billion Qi-compliant devices sold in 2023, the total SEP royalty market value as of last year is estimated to be between US$200 million and US$850 million when only considering Via LA SEP licensors. Since not all Qi SEP holders are members of the patent pool, the total royalty market is expected to be beyond the $US1-billion mark.

For the Via LA pool, patents are pre-screened for essentiality by independent patent reviewers. Pool members have publicly shared their verified Qi SEPs and Powermat has also publicly declared its Qi patents. However, there is no public patent declaration database. Analysing the Qi patent landscape, it is estimated that Via LA pool members represent around 26-36% of the total stack of all Qi patents (depending on the data refinement). This would mean that 64-74% of Qi patents are outside of the pool – and these portfolios are not public. This creates challenges for both Qi patent licensors and patent pools as well as Qi-standard implementers.

To identify Qi-related patents, IPlytics utilised LexisNexis’s Cipher machine-learning algorithm, which uses true-positive examples (eg, pooled patents) and true-negative examples of non-Qi-related patents as training data to build a technology landscape. From this broad view of the Qi patent sphere, random samples of patents were presented to subject-matter experts to confirm the Qi patents and identify others that have no relation to the Qi standard. These new examples of true-positive and true-negative patents are then again used as training data – an iterative approach to creating a comprehensive overview of the Qi-related patent space. However, it should be noted that this Qi patent landscape includes both verified SEPs and non-SEPs (ie, patents related to the Qi technology but that are not essential to the Qi-standard implementation).

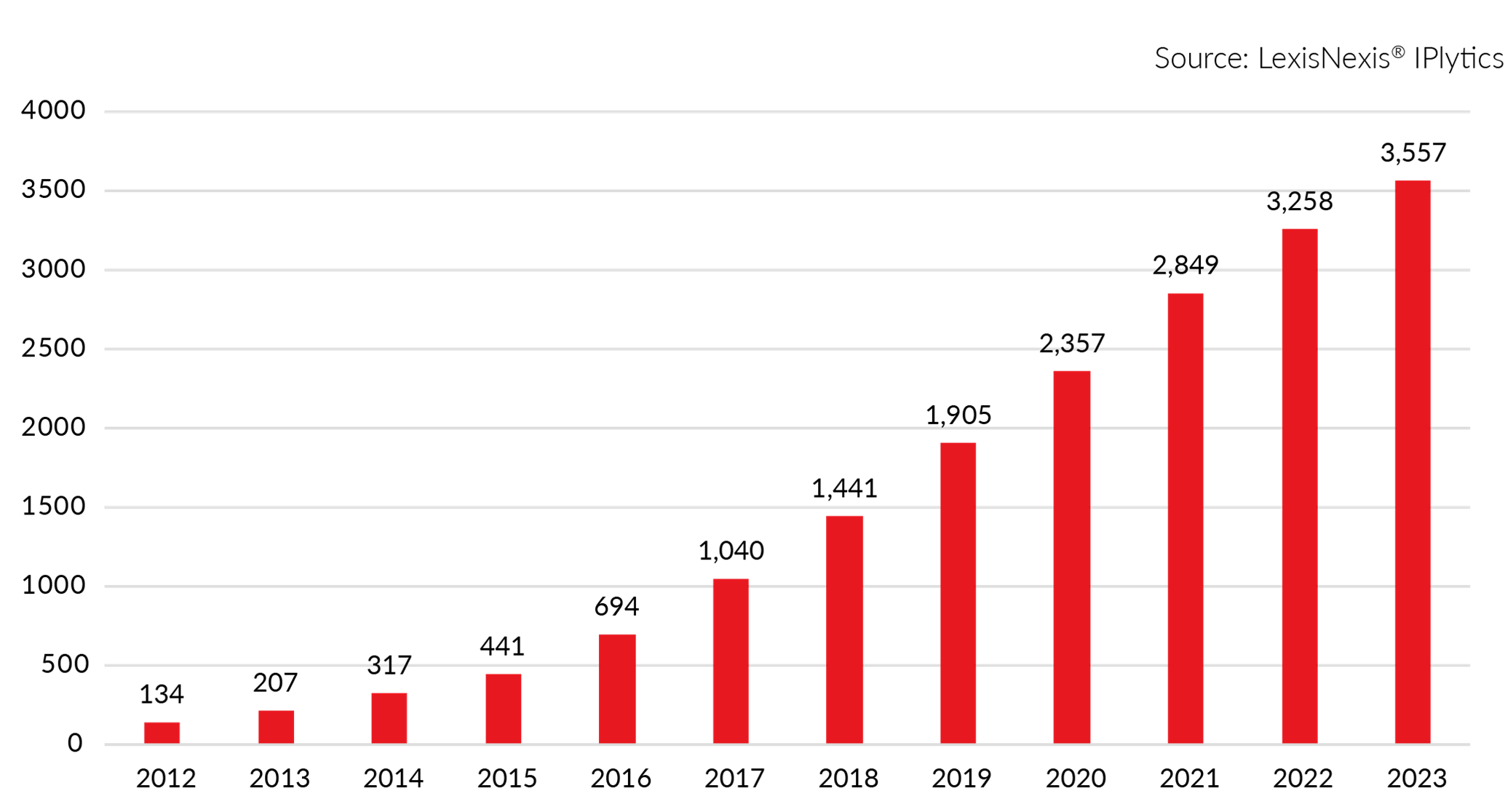

As of 31 January 2024, the Qi-related patent landscape included 3,557 active and worldwide-granted patent families.

Counting patent families by year of first patent publication shows that the cumulative number of Qi-standard patent families has rapidly increased over the past 10 years by more than factor 17 (see Figure 1).

Figure 1. Cumulative number of worldwide active and granted Qi patent families by year of first publication

Qi-related patent leaders

Table 1 illustrates the top Qi-standard patent owners – sorted by the number of Qi patent families (using the INPADOC patent family definition) – where at least one family counterpart was granted and active in at least one jurisdiction. It is worth noting that six of the top 12 patent owners in Table 1 are licensors to the Via LA Qi pool.

Table 1. Top Qi-related patent owners by number of Qi-related patent families

| Ultimate owner | Country of HQ |

|---|---|

| Samsung | South Korea |

| Apple | United States |

| Canon | Japan |

| LG Electronics | South Korea |

| Panasonic | Japan |

| Philips | Netherlands |

| LG Innotek | South Korea |

| Qualcomm | United States |

| Sony | Japan |

| Chemtronics | South Korea |

Looking at the Qi technology landscape provides a starting point for both SEP licensors and licensees to enter a commercial discussion about Qi patent portfolios. The SEP royalty market is lucrative and sharply increasing; with one billion Qi products sold last year, the market for licensing these SEPs seems to have huge royalty income potential – but SEP licensing for the Qi standard seems to be in its infancy. It appears that SEP owners are still waiting and observing the market to ensure wider adoption of Qi. With the release of Qi 2.0 and its expected increase in product adoption, the usage of wireless charging is likely to expand. This could trigger the Qi SEP licensing market to finally take off in the next year or two.

Unlocking value through actionable patent insights

Qi-standard SEP licensors

While only 26-36% of Qi patents are publicly disclosed, a comprehensive Qi patent landscape is critical for successful SEP licensing. The IPlytics analysis of this space reveals an insight into related patents that are not publicly listed.

This enables portfolio managers to:

- identify strengths and weaknesses of their portfolio;

- benchmark against competitors; and

- make informed decisions on portfolio development.

Licensing departments might use this information to:

- filter out irrelevant patents in portfolios;

- focus resources on valuable, licensable patents; and

- monitor market and ownership changes.

With over 9,000 Qi-compliant products, the royalty potential is substantial, so Qi patent owners should actively monetise their portfolios.

Qi-standard SEP licensees

Qi-compliant product manufacturers should prepare for patent holders and pools to start seeking royalties soon. Analysing the Qi patent landscape is an essential first step in preparing for FRAND licensing negotiations. Mapping out the numerators and denominators enables the determination of individual patent holders' and pools' share of all relevant Qi patents. With this data, manufacturers can compare licensing offers and assess the relative value of different patent portfolios. Monitoring patent filings and ownership trends also helps to quantify risks and forecast future royalty expenses. This includes tracking activity from patent assertion entities that are acquiring Qi patents.

The road ahead

It is expected that the Qi-standard technology will become one of the most crucial standards to enable cordless charging – not only for smartphones and tablets, but also in cars, offices or any surface where users could place their devices. The Qi standard is subject to an increasing number of patents that must be licensed when products come to implement the technology, and IP professionals and patent licensing executives should bear some key considerations in mind.

- Future technologies will increasingly rely on patented technology standards, such as the Qi standard.

- IP professionals must consider working with Qi patent data as a starting point to understand the total stack of Qi patents and the share of the patent owners’ portfolios.

- IP decisionmakers should consider dynamic market changes, where patent assertion entities often acquire portfolios to assert extensive royalty payments.

- IP professionals must be aware that while the market for wireless-charging standards is fairly new, it is now time to think proactively about what businesses will need in two, five and 10 years’ time – as well as what patent portfolios will need to support them – so as to not get left behind.

IAM recommends

South Korea most likely to take the lead in lithium-ion battery race

Impinj collects $45 million plus annual royalties from NXP in patent cross-licence pact

This is an Insight article, written by a selected partner as part of IAM's co-published content. Read more on Insight

Copyright © Law Business ResearchCompany Number: 03281866 VAT: GB 160 7529 10