South Korea most likely to take the lead in lithium-ion battery race

Lithium-ion batteries are integral to modern life, powering our smartphones, laptops, electric vehicles and countless other gadgets and devices. As the world moves towards renewable energy and electric transportation, the demand for better performing and cheaper lithium-ion batteries is skyrocketing.

Patent analysis reveals that South Korean companies are likely to dominate the lithium-ion battery patent landscape in the near future, surpassing Chinese, Japanese and US firms in both quantity and quality.

The importance of lithium-ion batteries

Lithium-ion battery technology is a crucial part of three mega-trends: mobile electronics, renewable energy and electric vehicles. It enables the portable devices that have become essential to modern life and are critical for storing energy from renewable sources, such as solar and wind power. As the world transitions to clean energy, massive storage capacity will be needed to overcome the intermittency of renewables. The batteries also make electric vehicles possible; as electric cars continue to gain market share, demand for high-performance and low-cost lithium-ion batteries is accelerating.

With so much at stake, innovation in lithium-ion batteries is heating up.

Patent landscape development

Analysis of patent filings and grants provides a window into R&D activities and technological competitiveness. However, studies show that only 20 to 40% of all patents have commercial value. For this reason, in addition to quantity metrics, the Patent Asset Index was applied as a quality measure to investigate market forces in this space.

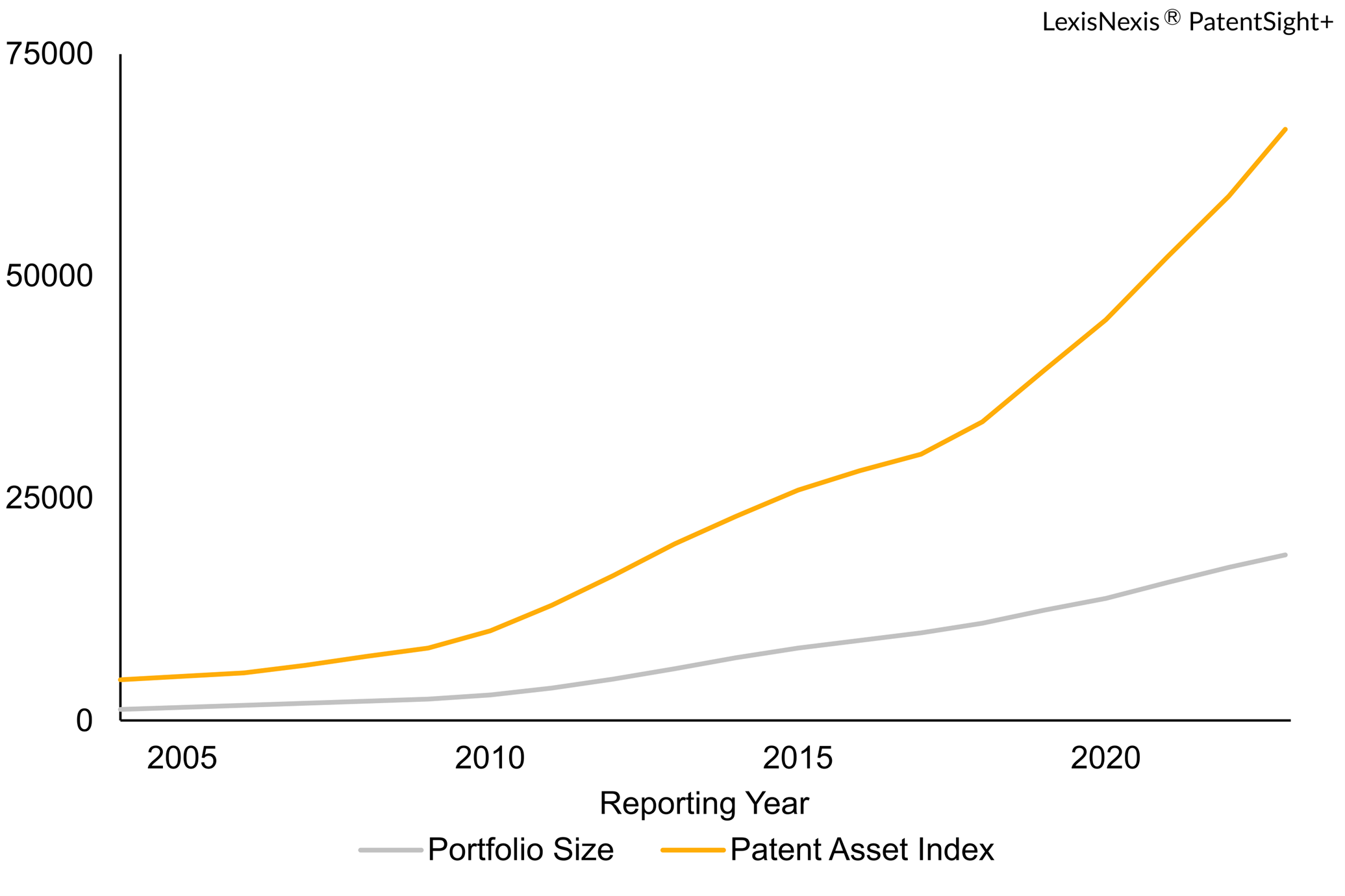

Figure 1. Portfolio size (Patent Asset Index)

Analytics show that the global lithium-ion battery invention space has expanded massively in terms of portfolio size and strength over the past 20 years – both have increased 14-fold. The rising gap between the quantity and the quality line suggests that the average quality of lithium-ion patents has increased over time and is indicative of a technology race to improve battery performance.

Shifting market forces

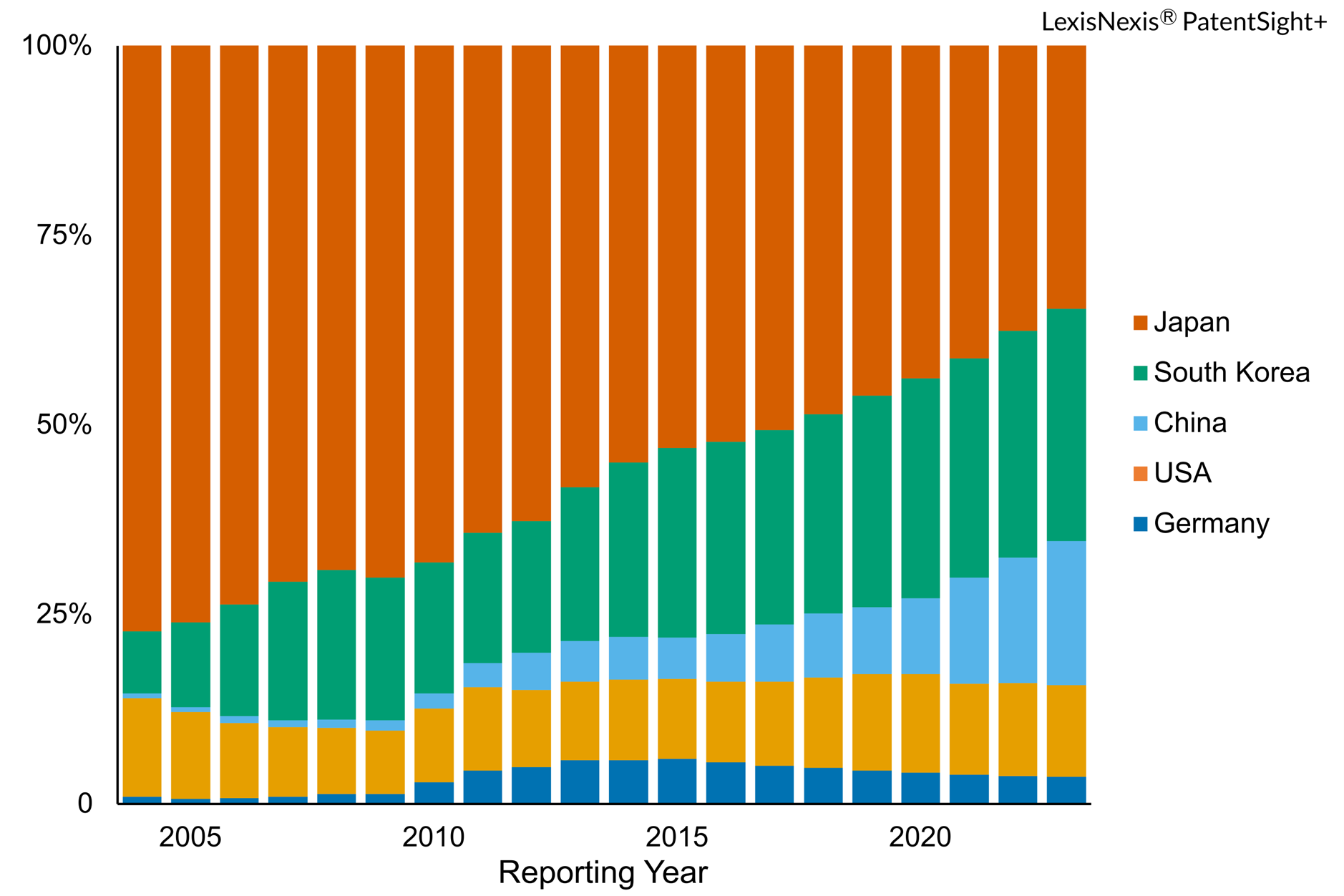

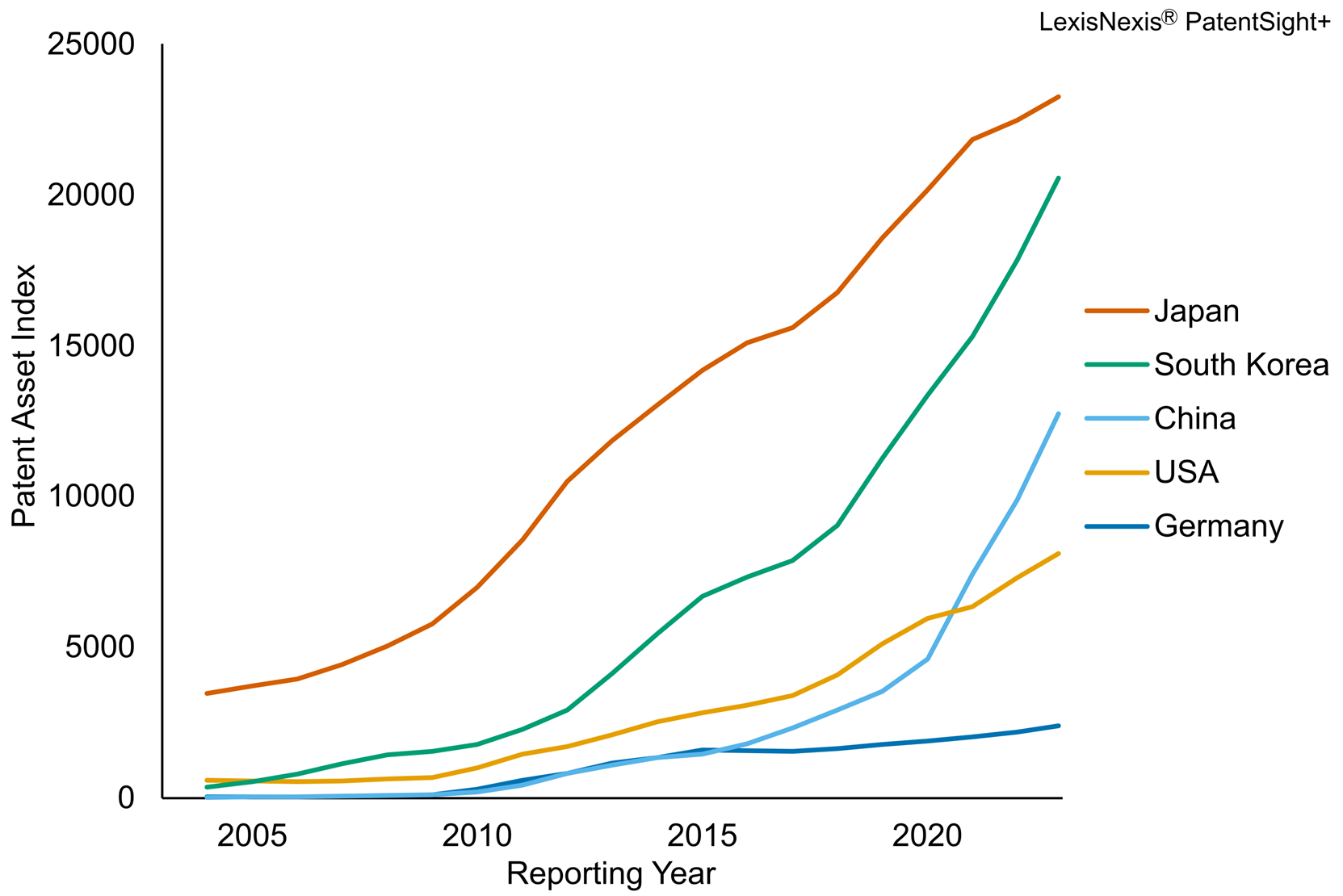

Just 15 years ago, Japanese companies accounted for almost 80% of lithium-ion battery patents – as measured by the Patent Asset Index – and are still leading with the strongest portfolios.

Through heavy R&D investment and high-quality patenting, South Korea has moved from a portfolio strength contribution of only 8% in 2004 to 31% at the end of 2023. China's aggressive increase in the relative share of portfolio strength is also noteworthy, especially in recent years. South Korea and China show similar dynamics in development of strength and are evolving faster than Japan, with Germany and the United States progressing at an even slower rate.

South Korea's rise to becoming a key player in this space has been steady but rapid. If this trend continues, the country is likely to take the top position from Japan very soon; we will, at least, see a highly competitive head-to-head race between China, Japan and South Korea within the next few years.

Figure 2: Patent portfolio growth/strength 2004-2023

Global top 10 lithium-ion battery patents by quantity and quality

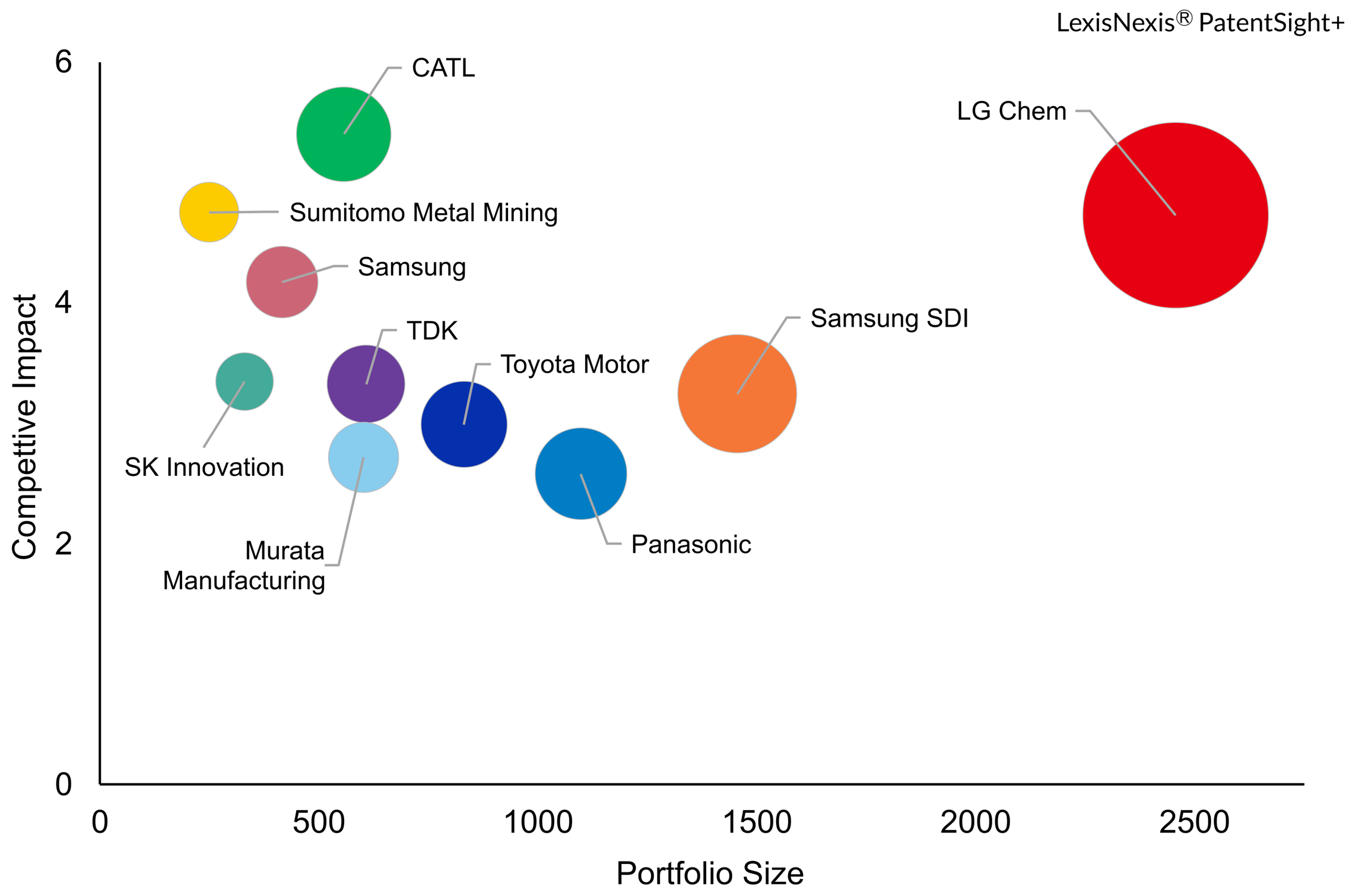

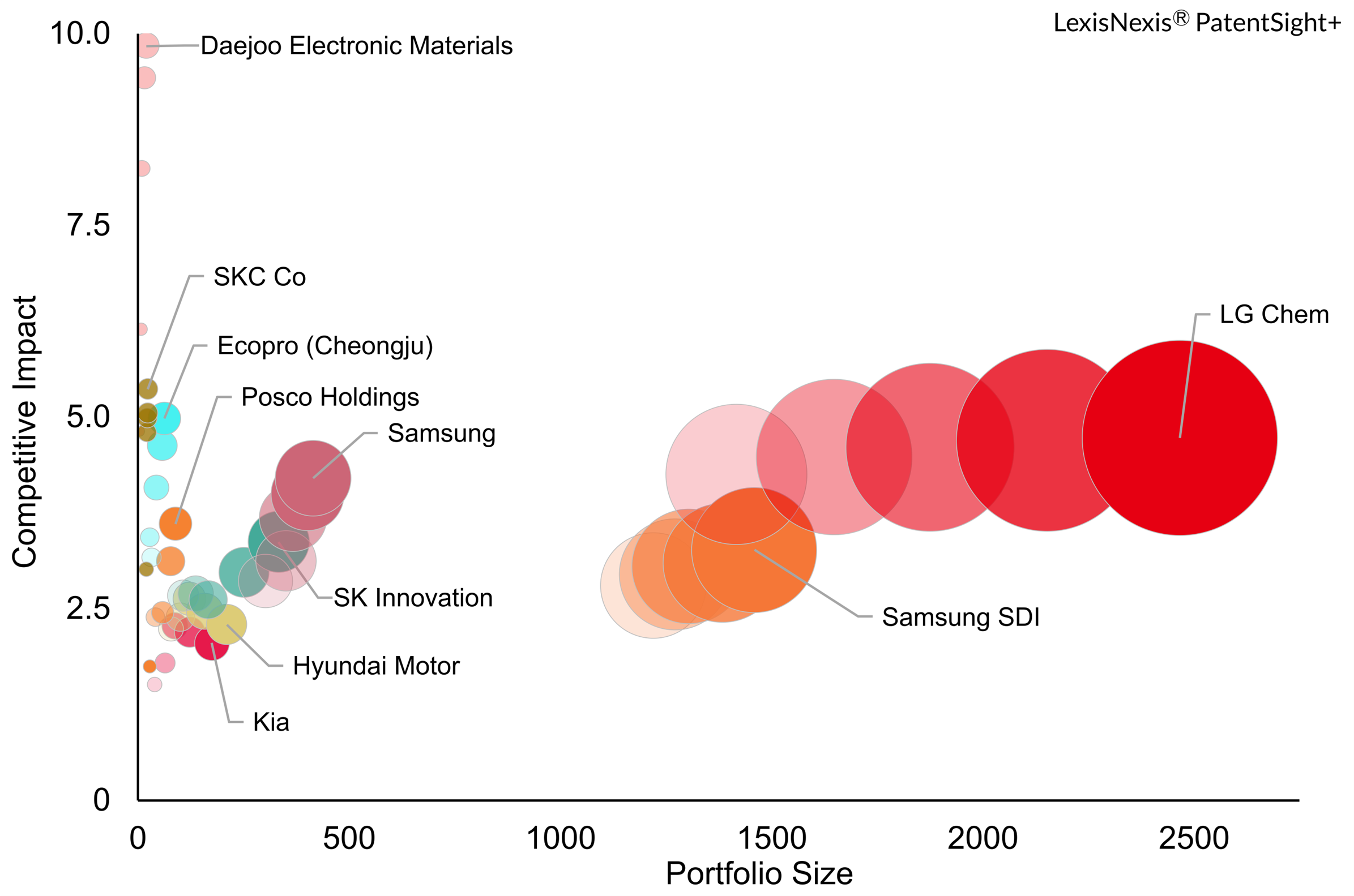

The analysis further highlights that leading Korean companies like LG Chem and Samsung SDI have strong positions in both metrics – quantity (a-axis) and average quality (y-axis) – contributing to an overall increase of their portfolio strength (bubble size) of patents over time (see Figure 3). LG Chem has the largest and strongest patent portfolio, while CATL’s portfolio has the highest average patent quality (competitive impact).

Other major players include Panasonic, Toyota Motor, TDK, Murata Manufacturing, Samsung Electronics SK Innovation and Sumitomo Metal Mining.

Figure 3: Patent portfolio strength over time

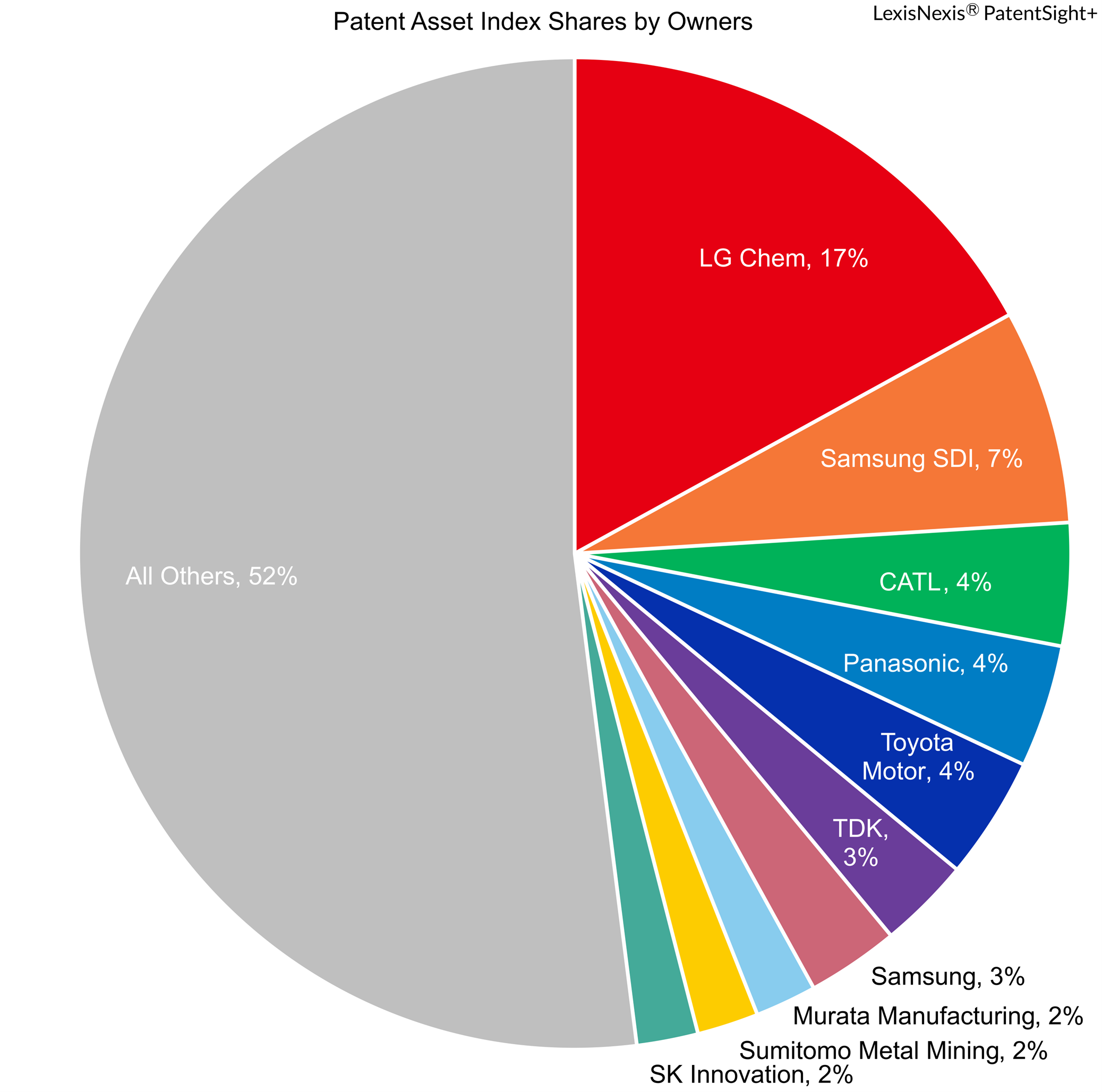

South Korea reigns among top 10 patent owners

Lithium-ion battery innovation is highly concentrated. The top 10 companies account for 48% of the total Patent Asset Index in this field, which indicates that overall growth is largely driven by just a few dominant players. Of these top 10, South Korean firms hold the greatest share at 29%, compared to 15% for Japanese organisations and 4% for Chinese companies. LG Chem leads with the single biggest share, accounting for 17% of the top 10's total patent strength. The outsized contribution of these major Korean players demonstrates the country's ascendance as a lithium-ion battery innovation powerhouse and its stake in the top 10 reflects its rise to the forefront of this critical industry.

Figure 4: Patent Asset Index shares by owners

South Korean companies in the top 100

There are several promising South Korean firms among the top 100 players. LG Chem and Samsung SDI have built large high-quality patent portfolios that continue to expand, which defies the trend of patent quality decreasing as portfolios grow – Hyundai Motor and Kia have seen their patent quality decline slightly in recent years as their portfolio sizes increase. However, Samsung, Posco and Ecopro are demonstrating impressive momentum. Despite having smaller patent portfolios, they have rapidly increased patent quality in the past few years.

With both veteran and emerging innovators, South Korea is well represented in the top 100 global lithium-ion battery patent holders. The country appears to have a diverse base of companies driving progress in this critical technology.

Figure 5: Patent portfolio strength of South Korean companies

Supporting the UN’s Sustainable Development Goals

These technological advances strongly align with several of the UN’s Sustainable Development Goals (SDGs). Lithium-ion innovation is incredibly relevant for SDG 9 (building resilient infrastructure and promoting sustainable industrialisation) and SDG 13 (urgent climate change action). Widespread adoption of lithium-ion storage supports expanded renewable energy and electric transportation, helping to curb emissions.

Lithium-ion patents also contribute to SDG 7 (ensuring access to affordable and clean energy) and SDG 12 (responsible production and consumption). By driving progress in green energy and electric vehicles, lithium-ion patent holders play a key role in sustainable development and have the potential to accelerate the global transition to an equitable low-carbon future, which supports the UN's 2030 agenda.

Figure 6: The UN’s Sustainable Development Goals

With lithium-ion batteries sitting at the heart of this global energy transition, leadership in this space yields major economic and competitive advantages. Japan and South Korea's battery companies appear poised to leverage their hard-won patent dominance into further success.

Holistic patent analysis is needed

While large patent portfolios grab attention, smaller players can also drive meaningful innovation. For example, Posco, Ecopro and Daejoo Electronic Materials have relatively modest lithium-ion battery patent holdings, but analysis of quality benchmarks (eg, the Patent Asset Index) reveals that these companies are rapidly increasing patent competitiveness.

By only assessing portfolio size, it is easy to overlook threats from focused players that are making quantum leaps through high-impact R&D. Tracking quality indicators exposes the rising stars – even those with smaller portfolios.

A holistic and nuanced analysis that considers both patent quantity and quality will provide a more accurate map of the competitive landscape. This will foreground genuine technology frontrunners and hidden IP disruptors, regardless of portfolio size.

IAM recommends

Patent analysis reveals high-performance computing semiconductors behind AI boom

Top Chinese EV battery maker wins patent battle but war with rival set to continue

South Korea: IP Office’s DABUS Nullification Highlights Stance Towards AI Inventors

This is an Insight article, written by a selected partner as part of IAM's co-published content. Read more on Insight

Copyright © Law Business ResearchCompany Number: 03281866 VAT: GB 160 7529 10